What’s next in mobile video: offline streaming

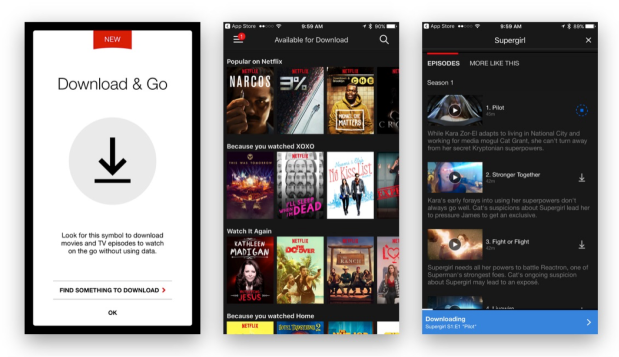

Download & Go: Netflix Offline Streaming

As video consumption on the smaller screens and out-of-home viewing continue to grow, offline viewing is set to become a staple for the video streaming services. Offline viewing is by no means a new phenomenon. iTunes has long allowed it for the purchased content, in fact, Google Maps launched the offline capability in Nov 2015. About the same time when Amazon Prime Videos, the first streaming service to have enabled offline viewing for its content library.

Mobile videos are growing at a rapid clip; The Streaming Video Alliance released their latest report Mobile Video: Exposed that states that 25% of consumers watch more than 2 hours of video on their smartphone each week, and according to another study smartphones are used to watch full episodes, delivering over 30 minutes per viewing session.

An Ooyala report states, mobile devices now constitute more than half (51%) of all online viewing. This represents a 15% increase from a year ago and a staggering 203% from 2014. In 2015, 139.8 million U.S. users were watching video content on their mobile phones.

Operators, service providers and TV networks are beginning to recognize the untapped opportunity. Earlier this year, Starz unveiled its over the top (OTT) streaming service that also allows both, its streaming service and Pay TV subscribers to download the majority of its library for offline streaming.

Netflix’s announcement of the offline feature in late November has pushed this to the forefront.

For long, Netflix executives had resisted providing this option, despite being one of the most asked for feature by its subscribers. In April 2016, CEO Reed Hastings seemed to reverse this position on the company’s earnings call.

“We should all keep an open mind on all this.”

It is not unsurprising, however to see them change their position, the on-the-consumer spends almost 70% of their out of home according to Kinetic. Mobile video consumption is meteoric, it is estimated videos will account for 75% of all mobile traffic by 2020. This has created a huge demand for data that has also provided an opportunity to the carriers to differentiate from the competitors. T-Mobile has launched Binge On that lets its subscribers watch videos from 24 different media sources including Netflix and Hulu without having to pay extra in data charges.

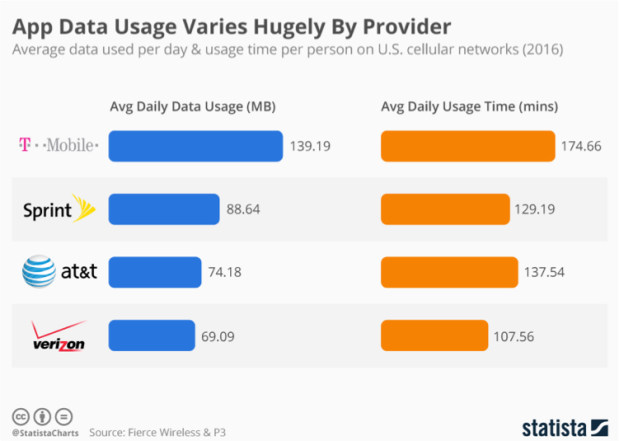

As seen in the Statista chart below, T-Mobile’s zero-rating (i.e. data charges are not applied) of apps such as Netflix and Spotify has made its customers heavier users of data and their daily usage is more than that of the other competitors. Increased time spent benefits the carriers as they can monetize these consumers. Offline capability would most likely enhance it even more.

While these offsets in data caps are becoming important to carriers and consumers the mobile Internet connectivity or lack thereof continues to mar the content experience.

In fact, the industry has coined the term “Buffer rage” to explain the sense of frustration consumers experience when their content does stream in real-time, which is now become a table stake. In a Limelight Networks study, The State of Digital Downloads, consumers ranked performance (i.e., streaming with no buffering, pages loading quickly) as more important than consistent experience and personalized content.

The result of this poor performance often if not always is lower engagement, that is consumers tend to exit the mobile video stream decreasing the completion rate.

Aside from the poor satisfaction that accompanies the slow speeds The Ericsson study found that with higher delays the consumers also began to place some of the blame on the content provider. Speed and reliability are value drivers.

When HBO Now – the streaming OTT (over the top) service by HBO went down during the airing of the penultimate episode of the wildly popular series, Game of Thrones, it drove throngs of angry fans to take to social media to express their frustration.

This should be a concern to not only the subscription video on demand (VOD) providers but also to the advertising supported VOD (AVOD) providers. As this could mean that for AVOD services, the poor streaming experience of a video can rub off on to the advertisers.

FreeWheel reported a 63% year over year increase in video ad views on smartphones, as viewers replicate the TV experience in the digital living room and outside the home. The Streaming Alliance study also shows that the Millennials tend to favor the phone over other form factors (i.e., tablets and some streaming devices) and watch more of the longer-form content. Hulu’s Ben Smith mirrors the sentiment stating in an interview that while there is a bit of a user bias toward short video clips, but in general mobile viewers watch the same types of content as TV or PC viewers.

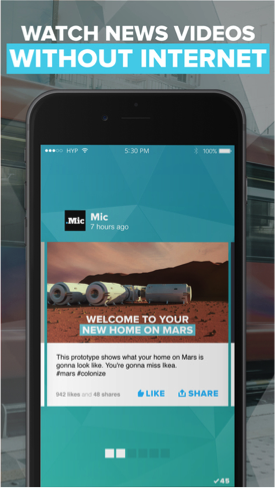

Other content providers are testing offline delivery of content. Hyper News is an app that delivers videos of the latest news to its users for offline consumption for the on-the-go consumer who experiences inconsistent and intermittent connectivity. “Hyper News was created to solve that exact problem. Whenever you’re connected to WiFi — at home or in the office — the app syncs in the background to make sure the latest news videos are always preloaded to your phone. So you get to enjoy buffer-free news videos on the go, even without Internet,” says Markus Gilles, co-founder, and CEO at Hyper in a Techcrunch article.

Other content providers are testing offline delivery of content. Hyper News is an app that delivers videos of the latest news to its users for offline consumption for the on-the-go consumer who experiences inconsistent and intermittent connectivity. “Hyper News was created to solve that exact problem. Whenever you’re connected to WiFi — at home or in the office — the app syncs in the background to make sure the latest news videos are always preloaded to your phone. So you get to enjoy buffer-free news videos on the go, even without Internet,” says Markus Gilles, co-founder, and CEO at Hyper in a Techcrunch article.

The mobile screen is becoming as much a primary screen as the TV screen. The tendency for consumers on mobile is to jump in and start consuming, which has created a need for instantaneous access, regardless the Internet connectivity. It goes without saying that an engaged viewer is more satisfied and a profitable one.Offline viewing can drive revenue opportunities. Some of the ways in which companies could do this are

- Selling stickiness

- Sponsored data

- Incentivized bandwidth

Although the jury’s out on Netflix’s offline viewing feature, it is likely to drive growth in the viewership for all of its content. An increase in viewership is an indication of the service’s stickiness. Providers could sell stickiness through tactics such as ‘sponsored reminders’ via app notifications or mobile messaging apps that encourage consumers to download recommendations. This also could increase the consumption of archival content, while improving retention rates. Advertising subscription video on demand (AVOD) could also preserve the ads as part of the offline experience, similar to YouTube’s offline feature in countries like India.

Carriers are using data offsets to encourage engagement with the video content, and these data incentives could be used sponsored by advertisers. Increased data cap could mean consumers spend more time with their devices, which could also lead to more discovery of other apps and content.

Content providers are constantly at odds with the mobile carriers and Internet service providers for heavy traffic share. As the standalone mobile OTT services grow data traffic will intensify. According to Cisco’s report, mobile video will increase 11-fold between 2015 and 2020. The same report also finds that video usage peaks in the evening, creating a period of prime time. Consumers could be incentivized to download for offline viewing to reduce the load at such peak times.

“If you look at predictions for 2017, I think bandwidth will be the hot topic, both in public policy, in mobile and in app design.” – Ben Smith, Senior Vice President and Head of Experience, Hulu

The reality is that the continuous connectivity is a future possibility. However, it is imperative that the delivery of the consumer experience is superior for all the industry stakeholders, and offline can provide a better online experience.